Merchants can either create a payment page from scratch or integrate a secure hosted payment page into their sites. Creating a dedicated payment page requires time and resources that many small merchants cannot afford that include obtaining PCI certification, design, development, integration with multiple payment methods, and liability costs. Working with a payment service provider (PSP) that provides a hosted payment solution eliminates the need for these separate resources and allows the merchant to allocate their budget elsewhere.

1. High-level security

Enterprise-sized companies have the financial resources to invest in PCI certification, risk and fraud departments, and building internal security protocols. The majority of online merchants lack these financial resources, but more importantly – they lack the need to invest precious assets when an effective solution is available.

Using a PSP with an integrated payment solution that is already PCI-certified and with high-level security measures in place enables merchants to focus on their core business. PSPs handle all compliance and fraud-related inquiries and are constantly updating their security measures, as they specialize in data security and fraud prevention.

2. No need for design resources

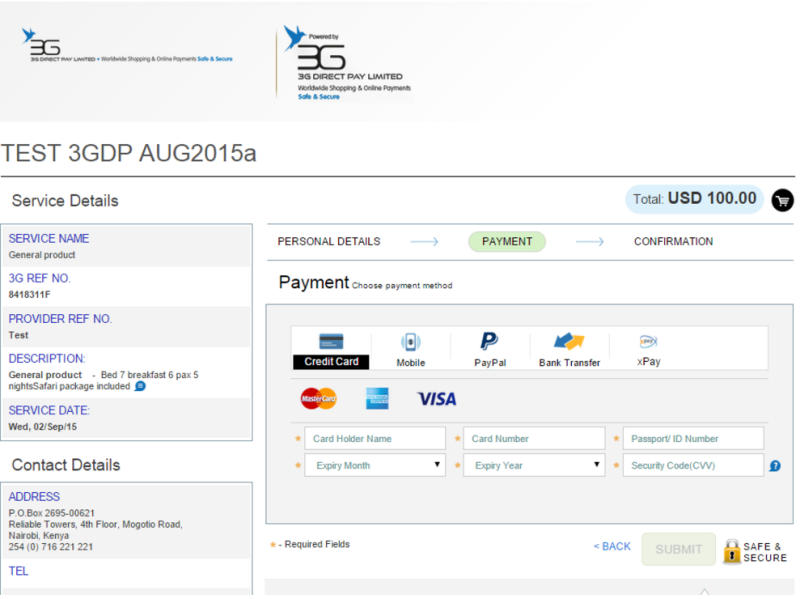

PSPs like 3G Direct Pay have already invested significant financial resources in building optimal payment page designs that are responsive on various devices, maximize conversions and ensure customers complete their purchases.

These pages are regularly optimized to provide the best solution possible. The templates do allow merchants to customize the payment page with their logo and colors, enabling them to provide a seamless experience where customers might not even be aware that they have been transferred to third-party page.

3. Save on development costs

Building an online payment page is very costly in both time and development costs. By utilizing a secure hosted payment page from a PSP, merchants can circumvent the need for an in-house or freelance development team and quickly accept online payments.

4. Save time on integration

When creating a dedicated online payment page, merchants need to individually integrate each payment method, each currency, and – if needed – translate the page into multiple languages. However, hosted payment pages already have a wide variety of payment methods integrated. PSPs also have multilingual and multicurrency payment solutions built into their payment pages, thus combining weeks, and even months, of integration resources into very minimal integration time.

5. Reduced merchant liability

As mentioned earlier, payment service providers invest the bulk of their resources on securing their payment pages. As such, hacking is very rare on hosted payment pages. In the unlikely event that hacking occurs, the merchant is not obligated to cover losses incurred. Using a hosted payment page significantly reduces risk for the merchant. It is important to note, however, that merchants are still responsible for upholding basic security measures to keep their customers’ information safe as well, but the level of PCI compliance will be much lower as the merchant will not be storing credit card data directly on their servers.

Online consumer shopping is constantly on the rise and, consequently, so is credit card fraud. Merchants are faced with a need to set up secure and affordable payment solutions that will both allow them to receive online payments and provide their customers with a seamless purchase process that will make them feel safe. This is especially important on payment pages as it is the last step before becoming a paying customer. Any company that has incurred liability losses can attest to the huge benefit that a company specializing in payment security can provide.

Setting up merchant account services to accept online payments is a daunting task, but using ready-made payments pages isn’t for everyone. Some merchants prefer to invest their financial and IT resources in setting up their own online payment solution, thus ensuring they retain full control over all of the information related to their customers and their purchases. For many others, working with a PSP’s optimized payment page and built-in security measures provides the ultimate solution for accepting online payments. Using a hosted payment page provides merchants with a convenient, affordable, and secure solution for a fully-compliant payment process that will maximize conversion and allow the merchant to focus on their core business.