DPO Case Studies

Case Study – Zanzibar Restaurant Growth with DumaPay

A leading eatery and bar in Zanzibar offers guests a taste of the local cuisine and a variety of cocktails.

However, despite being a leading restaurant among tourists, there were a few key issues preventing the establishment from increasing revenues and providing an improved customer experience.

The Challenges

- The point of sale register was bulky and cumbersome to use. As the restaurant literally resides on a small island in the ocean, space is at a premium. Wasting important space on a machine which rarely worked was inefficient.

- The restaurant attracts many tourists. For many years the restaurant only accepted cash payments, but most customers do not carry much with them. With the closest ATM only accessible by car, guests were limited in their ordering options, and potential guests could not make a spontaneous choice to visit the restaurant, if they did not have enough cash on them.

- A few years ago, the restaurant added a PDQ (Process Data Quickly) machine enabling it to collect credit card payments. Due to its location, within the ocean, network coverage is limited. The restaurant had frequent problems with its credit card PDQ machine, so that visitors were again required to pay with whatever limited cash they had on them. Waiting for connectivity negatively affected the customer’s experience.

The restaurant required an easy-to-use solution for accepting a variety of payment methods from its customer base of visiting tourists.

DPO Solution

The restaurant integrated DPO’s mSwipe mobile payment system in 2016. mSwipe offered a mPOS (mobile Point of Sale) alternative to the bulky PDQ device, accepting credit cards, including pin-and-chip cards, as well as mobile wallet payments. In 2017, the restaurant began using the revamped app, DumaPay, which included an improved interface based on merchant feedback and a free pin and chip (EMV) reader.

DumaPay is a versatile tool for mobile payments, suitable for credit card, mobile money and even email payments. The app accepts all major credit and debit cards and offers its customers access to PCI DSS level 1 certified security on all payments.

Credit card payments can be manually input or accepted via the EMV reader. Invoices are emailed to the customer or sent by SMS, directly from the app, for a quick and easy, wholly mobile solution. The app is simple to use, with a short 2-step process for payment entry and mode of payment choice.

Results

The restaurant has seen a significant increase in revenues since the integration of DPO’s mobile payment solutions. DumaPay offered better connectivity, faster service, and a higher level of reliability to this leading establishment. Today, the restaurant cites DumaPay as its preferred payment method, due to its simple-to-use interface, mobile implementation, quick processing, and outstanding security. As it is a mobile solution, DumaPay also improved on the previous cumbersome POS device.

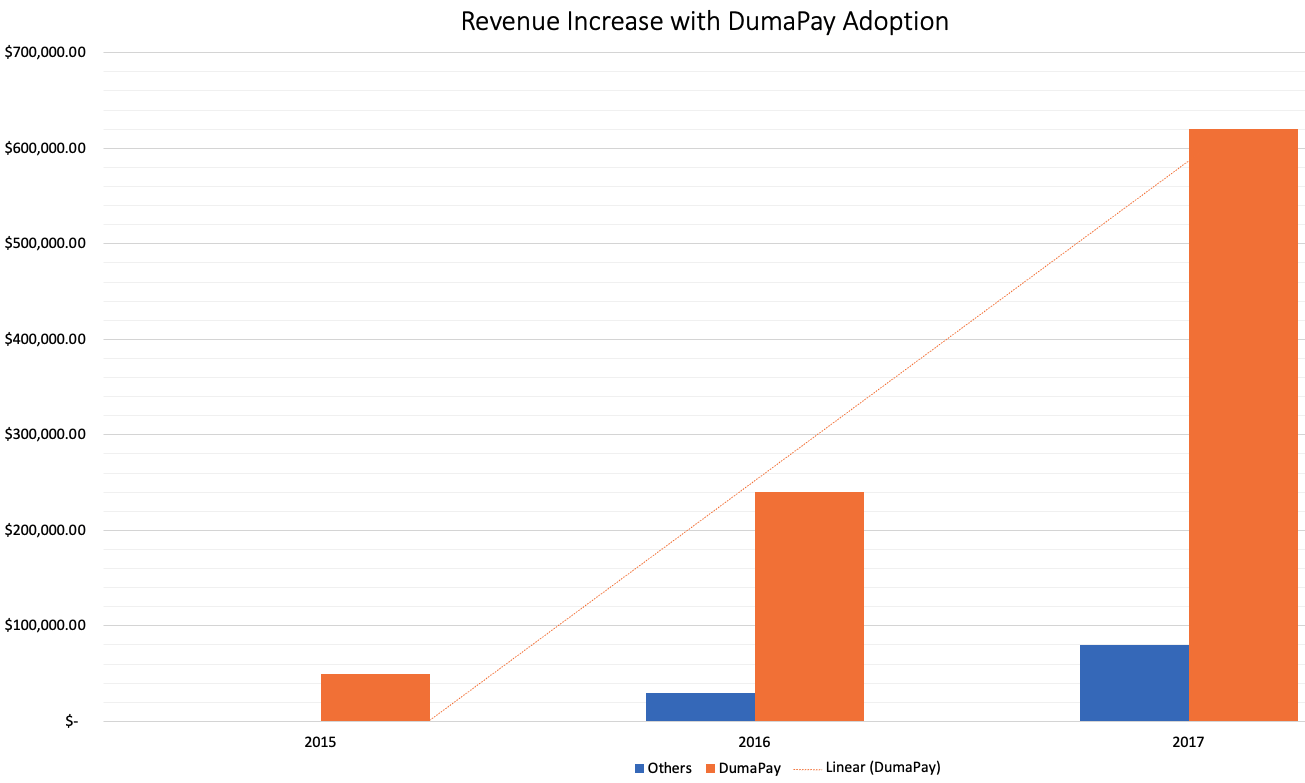

Today, this restaurant is the leading DumaPay user, with over 5,000 transactions in 2017. Since integrating DPO’s mobile payment applications, sales have skyrocketed from only 400 transactions in 2015, generating $49,000, to over 2,000 transactions in 2016, of which 1,900 were via DumaPay, and to over 6,000 in 2017, generating over $600,000 in revenues, representing 88% of revenues in that year.

DumaPay gave visitors the freedom to choose whatever they wanted on the menu, as they could pay with their credit card, and encouraged impulse buying and spontaneous visitors. The restaurant was able to upsell drinks and desserts, further increasing sales.

This DPO customer is a prime example of how a tourist venue can increase activity and revenues by catering to their customers’ specific payment needs. This highly flexible, advanced mobile payment alternative supports all modes of payment while offering security to tourists. Specifically, it is the optimal solution for remote vacation venues, allowing them the opportunity to upsell to customers without being limited by their clientele’s cash on hand.

To see how DPO’s solutions can improve your revenues and customer experience, contact us today.