In a new report of Kenya’s credit card and payments industry, the Market Research Store explores the political, socioeconomic, infrastructural, and demographic reasons for the growth of Kenya’s dominance as a hub of electronic payments in Africa. An oasis of peace and stability, if other African nations follow Kenya’s lead in embracing innovation and technology, a bright future of electronic payments will shine upon the region.

Boasting a compound annual growth rate (CAGR) from 2009 – 2013 of 26.32% in the number of cards issued and 34.40% in total transaction value, the debit, credit, and charge card ecosystem in Kenya is thriving.

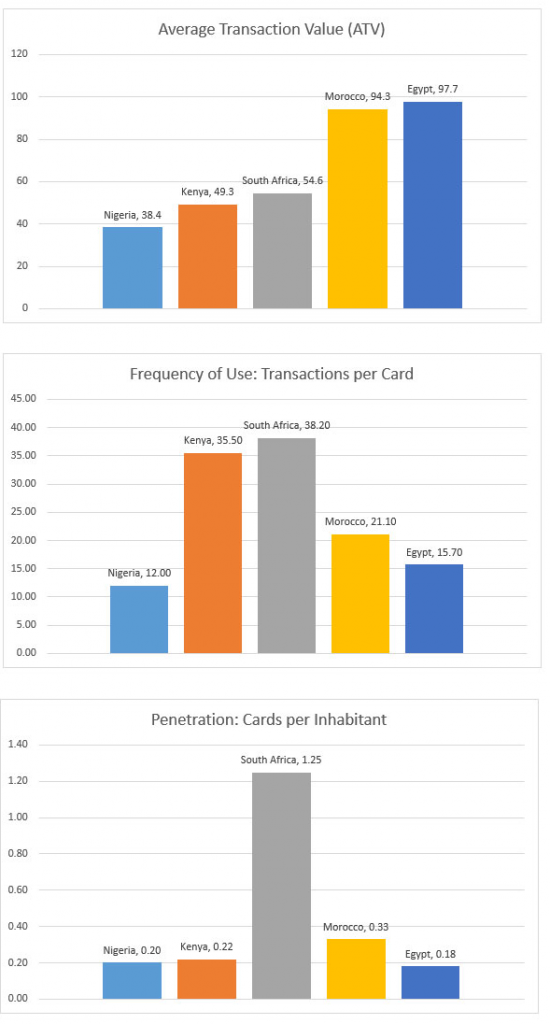

When compared to other leading African nations, Kenya is positioned nicely in average transaction value, frequency of use, and penetration of cards. On a level playing field with South Africa, Morocco, and Egypt, Kenya is holding its own, growing, thriving, and shaping the continent’s adoption of mobile and online transactions.

Mobile payments like those of M-pesa or Mi-Card and retailer prepaid credit cards like the ones issued by Kenya’s largest retail chain, Nakumatt, are among the innovations shaping and driving the market. Cross-industry advancements, like the Kenyan Public Transport Industry announcement, plans to introduce prepaid cards to pay for transport fares promotes electronic payments even further.

Large industry players like Vodafone subsidiary Safaricom and the Central Bank of Kenya (CBK) promote the uptake of mobile-based financial services to the rural, unbanked population.

The available report includes a comprehensive analysis of the ecosystem, current benchmarks and forecast for 2018, regulatory framework, marketing strategies, and profiles of major players.